US Federal Reserve Slashes Rates by 50 BPS, Signals Further Cuts Amid Economic Shift

US Federal Reserve Slashes Rates by 50 BPS, Signals Further Cuts Amid Economic Shift

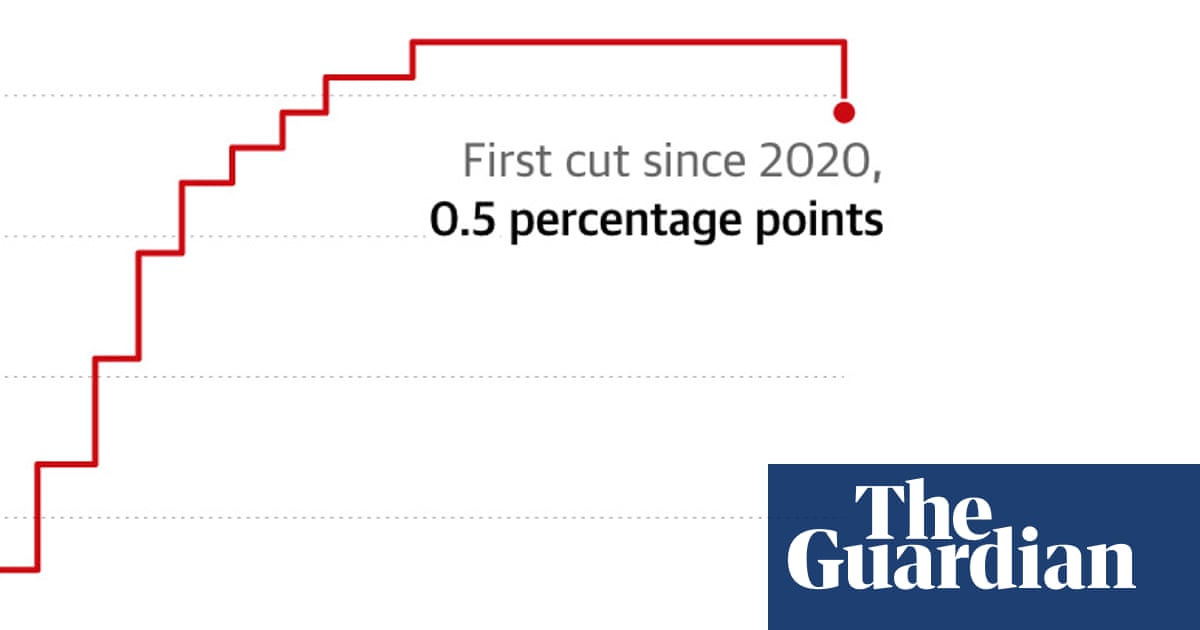

In a pivotal move signaling a significant shift in monetary policy, the US Federal Reserve cut its benchmark interest rate by 50 basis points on Wednesday, marking the first reduction in four years. This decision moves the federal funds rate target to between 4.75% and 5%, stepping back from an aggressive stance aimed at curbing inflation.

Policymakers also indicated expectations for an additional 50 basis point cut later this year, according to projections released alongside the announcement. While Wall Street initially reacted positively, the S&P 500 ultimately closed down 0.29%.

Fed Chair Jerome Powell addressed reporters, stating the decision reflects growing confidence that a strong labor market can be maintained while inflation continues its sustainable path towards the central bank’s 2% target. He emphasized that future rate decisions would be made on a meeting-by-meeting basis, expressing optimism that the US economy would avoid a recession.

The rate cut comes as inflation has dramatically receded from its 2022 peak, with the most recent August reading at 2.5%. Despite this progress, many Americans continue to face elevated costs for essential goods and services. With the presidential election less than 50 days away, the economy’s direction remains a critical campaign issue, though Powell firmly denied political influence on the Fed’s decision.

Disclaimer: This content is aggregated from public sources online. Please verify information independently. If you believe your rights have been infringed, contact us for removal.